As recurring revenue models dominate the billing landscape, understanding and managing the three financial pillars of bookings, billings, and revenue becomes critical. These key revenue lifecycle elements are essential for growth, cash flow management, and investor confidence. This blog takes a deep dive into the most effective strategies for managing these important metrics, ensuring accuracy and efficiency and the common pitfalls that can derail even the most promising SaaS businesses.

Given the more than 1,000 accounting and finance terms, it’s easy to understand why there may be some discrepancies. Although many of the terms are self-explanatory, others such as bookings vs billings vs revenue are frequently misunderstood and used interchangeably. Let’s demystify the terms, discuss their importance for B2B software-as-a-service (SaaS) organizations, establish when and how they are used, explain their impact on revenue and cash flow, and uncover real-world examples.

Managing Bookings, Billings, and Revenue in SaaS

What exactly are bookings vs billings vs revenue? Let’s start with the definition of each.

SaaS Bookings

These represent the total value of customer contracts signed within a given period. They are vital for pipeline analysis and future revenue forecasting. An indicator of future revenue growth, this forward-looking metric represents the start of the transaction or subscription. At this point, the customer agrees to purchase your products, services, training, renewals, etc., and commits to making payments for the duration of the contract.

For example, a $24,000 – 12-month contract is a ‘booking’ and cannot be considered immediate revenue.

SaaS Billing

This is the amount you will collect for the products and services provided during an accounting period. This is the amount you will collect for the products and services provided during an accounting period. A good representation of cash flow, the billing period spans a certain time period like a month, 6-months, a year, or longer. This metric includes products, services, recurring subscription fees, and other charges, such as consulting and training.

SaaS Revenue

This is recognized income that adheres to accounting standards. Revenue recognition occurs once the products and services reach the customer, i.e., the obligations have been fulfilled. For subscription-based SaaS companies this means the revenue is recognized at a predetermined rate over the life of the subscription.

As an example, a SaaS company bills the customer in advance for a year’s subscription, the business earns (recognizes) the revenue over the course of the year – as the contracted services are delivered. This is per GAAP rules, which indicate that revenue can only be recognized once it has been ‘earned’.

While these metrics enable SaaS companies to monitor, understand, and forecast business performance, each provides a different aspect of the organization’s performance and financial health. However, when analyzed in combination, they provide a picture of the company’s current sales, overall financial strength, future growth prospects, and cash flow. For example, a surge in bookings is a strong indicator that its billings and revenue will also increase.

Avoiding Common Pitfalls in SaaS Financial Management

Many SaaS businesses fall into the trap of equating bookings with revenue, which can lead to inflated growth assumptions and misinformed decisions. Overemphasizing bookings without tracking realization timelines results in missed forecasts. Failure to comply with ASC 606 revenue recognition standards can lead to audit risks.Relying on manual spreadsheets increases the chance of error and non-compliance.Tracking vanity metrics or isolated KPIs can distract from true business health. Deferred revenue is often overlooked, masking future service obligations.

Aligning Finance and Sales Teams Around Metrics

SaaS businesses thrive when their teams operate from the same playbook – but that’s often easier said than done. While sales departments typically focus on new bookings, pipeline growth, and closing deals, finance teams prioritize billings, collections, and recognized revenue. This divide can lead to challenges in planning, cash flow projections, and stakeholder communications.

One of the most common issues is the overemphasis on non-recurring bookings without factoring in delivery timelines, operational capacity, or downstream billing implications. Sales may be celebrating deals while finance struggles to reconcile them in monthly close. Without alignment, it’s easy to miss targets or inflate perceived performance.

Regular cross-functional meetings between finance, operations, and sales can bridge this gap. Reviewing forecast models, revenue targets, and customer contract obligations together helps unify strategic planning. Using shared dashboards built through billing system integration also gives all departments access to a single source of truth.

Establishing consistent terminology for recurring booking, total bookings, and recognized revenue, as well as documenting metrics in an internal glossary, helps avoid confusion. When everyone speaks the same language, teams stay aligned – and growth becomes more predictable.

Solutions for SaaS Businesses in Measuring Financial Metrics

It’s important for SaaS enterprises to use automated systems that enforce revenue recognition rules and regularly review metrics in the context of financial statements and cash flow. Creating a single source of truth for finance and operations through integrated platforms can help resolve future problems in measuring things such as recurring and deferred revenue. A mid-sized SaaS provider avoided a costly audit by moving to an ASC 606-compliant subscription revenue management system integrated with its billing and CRM tools.

Utilizing a single source of truth for revenue also provides the opportunity to standardize terminology and documentation for financial metrics and align financial reviews with monthly close processes. Tools like BillingPlatform help automate invoicing, billing schedules, and revenue recognition in a single revenue lifecycle platform, as well as integrate with ERP and GL systems to minimize reconciliation issues.

Improving real-time visibility with the use of financial dashboards that provide leadership with real-time insights can also help monitor cash flow, deferred revenue accounting, and churn in a unified SaaS billing platform.

Understanding Financial Metrics in SaaS Billing

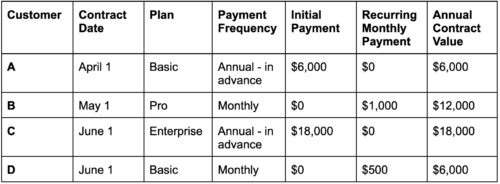

Our fictitious B2B SaaS provider sells three software plans – Basic ($500/month), Pro ($1,000/month), and Enterprise ($1,500/month). For simplicity, we’ll say that each of their 4 customers commits to a one-year subscription. 2 of the customers make the full payment in advance, while the other 2 pay monthly.

Bookings:

Regardless of how the customer pays for their subscription, bookings are the sum of all closed deals for the month.

- April bookings equal $6,000

- May bookings equal $12,000

- June bookings equal $24,000

Billings:

This figure includes the total amount billed each month. For customers paying monthly, the figure is the invoice amount. For customers paying in advance the bill is the total contract value. In this scenario, April billings equal $6,000, May billings equate to $1,000, and June billings are $18,500.

Recognized Revenue:

This figure includes the total amount paid and ‘earned’ each month. For customers that pay in advance, the company will include the amount of ‘earned’ revenue for the month – in this case 1/12 of the total subscription payment. Recognizable revenue for April is $500, May is $1,000, and June is $2,000.

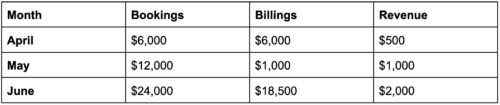

To make comparisons between the amount of bookings vs billings and revenue easier to see, let’s look at it in a table format.

As you can see, each of these figures represent different financial aspects of the company. While bookings provide the total purchase price and reflect sales momentum, billings show the expected monthly cash flow, and revenue highlights the amount the company actually earned during the month. When it comes to recognizing revenue, revenue can only be recognized when the conditions of ASC 606 are met, which adds a bit more complexity to financial processes.

What About Deferred Revenue?

Let’s take this one step further and discuss money that is billed and paid, but is not recognizable income. Deferred revenue (also called deferred income, unearned revenue, or unearned income) in accrual accounting is applied to payments received for products and/or services that have not yet been completely delivered.

The amount of deferred revenue is recorded as a liability until delivery is made, at which time it’s converted into revenue. For example, a SaaS provider sells an annual subscription for $12,000, and the entire contract is invoiced and paid in advance. The $12,000 is considered deferred revenue, and the company recognizes $1,000 each month as services are rendered.

While the above provides fairly straightforward examples, it’s easy to see how bookings, billings, and revenue recognition can quickly become complex, especially when customers cancel subscriptions, renew subscriptions, upgrade or downgrade plans, purchase additional products and services, etc.

The Impact of Bookings vs Billings vs Revenue Recognition on Revenue and Cash Flow

Bookings represent the customer’s commitment to pay for products and services and don’t directly impact financial reports. Billings affect the balance sheet (accounts receivable, deferred revenue, and cash balance). Revenues are recognized according to the revenue recognition principle, meaning that revenue is recognized on the income statement in the period when earned – not necessarily when cash is received.

Bookings include new customers, renewals, and upsells and reveal potential weaknesses, as well as areas for growth. For example, a decrease in bookings may indicate waning market interest or it may be an early sign of potential issues within the sales process. When it comes to billings, they provide an essential measure to the company’s ability to generate cash. Trends in billings provide critical insights into the financial health of the company, its growth or decline, and provides a cash flow measure.

Revenue recognition signifies that the company has fulfilled its obligations to the customer and knows the exact amount of income generated. However, by analyzing all three metrics a comprehensive picture of the company’s current and future performance can be determined.

Bookings vs Billings vs Revenue Recognition: Key Points

- Bookings are the total value of signed contracts

- Billings represent the amount billed to customers

- Revenue is the money earned once the purchased products and services have been delivered

- Upfront payments can improve the company’s cash flow

- Multi-year subscription contracts may increase bookings, but will not immediately contribute to revenue

- Bookings don’t always result in receiving the full amount of revenue reflected in the contract. Subscriptions can be canceled, invoices may become uncollectible, or the company may encounter difficulties in delivering the products or services

- An increase in bookings signals strong market demand. A decline in bookings may indicate waning customer interest, which will likely result in a decline of revenue

- Revenue can only be recognized once all contractual obligations are met

- While deferred revenue shouldn’t be considered either a positive or a negative, deferred funds do not equate to available cash

Leveraging Metrics for Growth and Forecasting

Recognizing the relationship between bookings vs billings vs revenue is the foundation to managing cash flow and accurately predicting the future financial health of the business. As such, it’s important for the finance team to carefully track these metrics. However, manually calculating these intricate metrics is not only time consuming but prone to errors.

Platforms like BillingPlatform provide predictive analytics tailored for SaaS. Forecasting tools should integrate with your billing and finance systems for up-to-date data. Using the tools provided, users can look at historical bookings, billings, and churn rates to model future ARR and MRR. Then, they can combine these insights with customer behavior and usage data for deeper forecasting accuracy, such as aligning product development and sales incentives with data from financial forecasts. A SaaS company even reduced churn by 18% after identifying high-risk customer segments through financial data and investing in targeted retention campaigns.

Improving Forecast Accuracy Using Integrated Metrics

Forecasting in SaaS is both art and science. Accurate predictions require more than sales projections – they depend on aligning revenue forecasting SaaS models with bookings, billings, and revenue metrics. Each of these elements plays a distinct role: bookings reflect demand and pipeline strength;, billings inform near-term cash flow;, and recognized revenue supports profit and loss statements.

Integrating these financial signals is essential for reliable forecasts. By combining historical booking-to-billing conversion rates and aligning them with deferred revenue schedules, finance teams can build more realistic models. This approach is particularly powerful when paired with advanced billing analytics that highlight churn risk, usage trends, and customer cohort behavior.

Connected systems are key. Platforms that support billing automation and real-time data sharing between finance and CRM tools reduce manual work and help identify discrepancies early. They also allow for more dynamic updates to forecast models, especially during periods of rapid growth or change.

Aligning teams around integrated forecasts not only reduces variance between projected and actual sales performance, but it also improves credibility with investors and executives.

Communicating Financial Metrics to Stakeholders

While internal alignment is vital, external clarity matters just as much. Stakeholders – including board members, investors, and auditors – need clear, consistent explanations of financial health. That starts with breaking down the distinctions between bookings, billings, and revenue.

Each metric tells part of the story. Without proper context, stakeholders may misinterpret a spike in bookings as increased cash flow or mistake deferred revenue for earned income. For example, renewal bookings may reflect strong retention but not signal immediate growth. To build trust, SaaS companies must present reconciled reports that highlight balances, timing, and ASC 606 compliance.

Adopting revenue recognition software that tracks delivery milestones, service periods, and allocation rules can help generate consistent, audit-ready documentation. It also supports clearer presentations of recognized revenue versus outstanding obligations.

Investors appreciate proactive communication. That means providing context around future revenue potential, such as upsell opportunities and expansion within current accounts. It also involves educating non-financial audiences on common SaaS financial practices and revenue recognition methods, particularly when new products or services are introduced.

When done well, this transparency boosts confidence, improves decision-making, and solidifies your reputation as a data-driven, strategically aligned SaaS organization.

Turning Financial Clarity into Strategic Advantage

Bookings, billings, and revenue are more than just accounting terms—they’re the heartbeat of SaaS business growth. When these metrics are tracked accurately, aligned strategically, and supported by automation, they become powerful tools for planning, execution, and scale.

BillingPlatform empowers SaaS companies to integrate, automate, and optimize every step of their financial workflows, helping turn numbers into insights and strategy into success. Our complete solution streamlines revenue management to allocate, reconcile, monitor, and recognize revenue for any pricing model, billing approach, or promotional offer, while staying compliant with ASC 606 and IFRS 15.

With BillingPlatform, you’re able to accelerate the close process with real-time subledger transactions that integrate into downstream ERP and accounting systems. Are you ready to streamline the billing cycle, reduce manual errors, minimize revenue leakage, and gain visibility into the financial data that will enable you to make more informed business decisions? We can help!