Fintech Innovation

Fintech Innovation

Fintech Innovation

Fintech Innovation

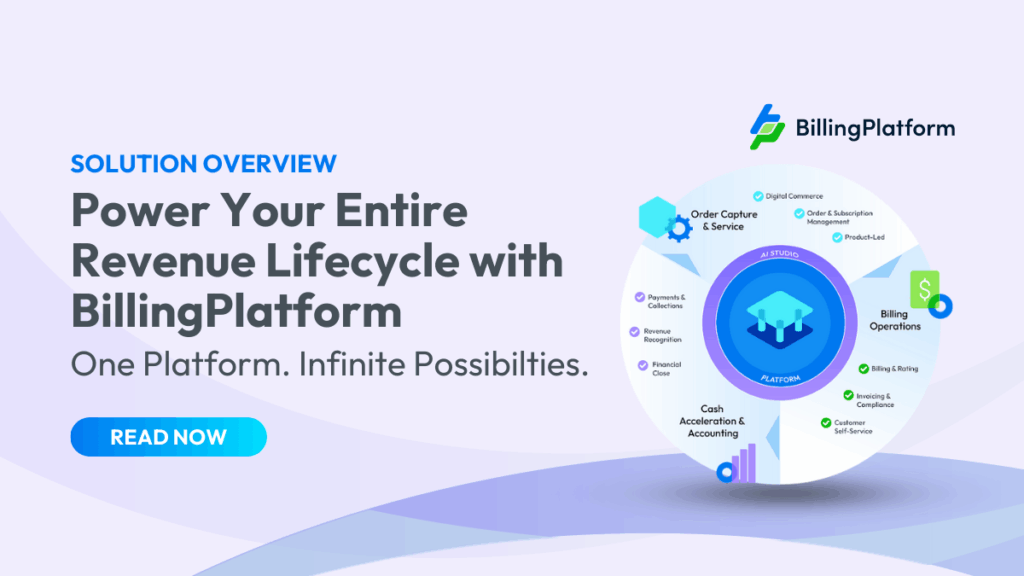

Accelerate Fintech Growth with Flexible Billing

Fast-growing fintech companies need agile billing that keeps pace with innovation. From dynamic pricing experiments and hybrid subscription models to market-specific compliance and API-first integration, BillingPlatform gives fintechs the scalability, flexibility, and control to expand globally with confidence.

Industry Focus

Scale quickly, experiment with pricing, and expand globally while staying compliant with international standards

Rapid Scaling & Dynamic Pricing Experimentation

Test, launch, and optimize new pricing models instantly with cloud-native scalability.

Learn More

Complex Subscription & Usage-Based Models

Support sophisticated subscription and usage-based pricing with hybrid flexibility.

Learn More

Regulatory Compliance & Rapid Market Entry

Stay compliant while entering new markets quickly with built-in frameworks.

Learn More

API-First Integration & Embedded Billing

Embed billing seamlessly and integrate with modern fintech ecosystems.

Learn More

“Our partnership with BillingPlatform provides us with a configurable solution that fits into our broader revenue lifecycle ecosystem to help us meet our complex billing needs, initially for our Treasury Services and Trade Finance business. BillingPlatform will be an integral part of our transformation to streamline the customer experience.”

Jill Jensen, J.P. Morgan Payments Technology

Managing Director

“We look forward to partnering with BillingPlatform to extend our reach to even more businesses and provide best-in-class billing and payment technology to our joint customers.”

Andrew Gilboy, GoCardless

General Manager, North America

“After researching multiple market options, BillingPlatform stood out as the ideal solution for InComm Payments based on its easy-to-use interface, scalability, and ability to handle our complex pricing and billing requirements.”

Dean Thompson Sr., InComm Payments

Director, Financial Information Systems

“As we expanded, we needed a billing solution that could not only handle our growing volumes and complexity but also integrated to critical third-party solutions to round out the entire billing and revenue management process, and BillingPlatform emerged as the best solution for our needs.”

Sarah Spoja, Tipalti

CFO

Rapid Scaling & Dynamic Pricing Experimentation

Scale Instantly and Optimize Pricing at Speed

Fintech growth demands constant innovation. BillingPlatform’s cloud-native architecture scales automatically, supports unlimited pricing experiments, and enables real-time A/B testing across customer segments. With instant deployment and comprehensive analytics, fintechs can experiment freely and grow without technical constraints.

Complex Subscription & Usage-Based Models

Support Advanced Subscription and Usage Scenarios

Digital lending platforms, neobanks, and crypto exchanges need flexible pricing models that go beyond legacy billing systems. BillingPlatform supports unlimited subscription tiers, usage-based fees, hybrid pricing, and dynamic adjustments based on customer behavior—all powered by automated usage tracking and real-time tier management.

Regulatory Compliance & Rapid Market Entry

Enter New Markets Quickly and Confidently

Fintech companies face varying regulatory, tax, and reporting requirements across jurisdictions. BillingPlatform provides built-in compliance frameworks, automated reporting, jurisdiction-specific tax handling, and rapid deployment capabilities. This enables fintechs to expand into new markets faster—without adding regulatory risk or technical complexity.

API-First Integration & Embedded Billing

Embed Billing into Every Fintech Experience

Modern fintech platforms require API-driven flexibility for embedded billing, white-label solutions, and third-party integrations. BillingPlatform delivers robust REST APIs, webhooks, and SDKs that enable seamless integration, real-time synchronization, and developer-friendly extensibility for rapid product launches.