Merchants in the EU are about to see an increase in credit card declines across the board.

The culprit? Payment Service Directive 2 (PSD2)

PSD2 is a regulation passed by the EU that aims to increase online payment security and expand the financial services ecosystem. EU member states hope to fight fraud by requiring stricter authentication requirements for online payments.

The legislation also encourages innovation in the space by forcing banks to share their customer account data with consumer-approved, third-party financial services vendors when requested. In addition, banks will take on more accountability around online payments, including managing chargebacks for rejected transactions.

PSD2 goes into effect on September 14th and has major implications for how merchants will collect payments going forward, especially as it relates to recurring, automated billing. Although the standard only applies to transactions born in the EU, we are likely to see similar actions in other parts of the world in the not-too-distant future.

What Is the Inspiration Behind PSD2?

PSD2 is designed to build on the first PSD (2007) by enabling a more efficient and unified payments market in Europe. The legislation applies to any businesses in the EU that collect payments from EU-issued credit cards.

One of the biggest issues PSD2 tackles is fraud related to recurring billing models, particularly around Merchant-Initiated Transactions (MIT). Today, implementing authentication for MITs is challenging as customers are not engaged when payments are rendered.

To address this issue, the EU developed a framework called Strong Customer Authentication (SCA), which is designed to bring MITs up to par with the security standards of Customer-Initiated Transactions (CITs). Enabled by 3D Secure Version 2 protocol, SCA requires at least two of the three authentication methods below for online payments:

- Something the customer knows (password)

- Something the customer is (fingerprint, face)

- Something the customer has (phone, hardware)

However, SCA also introduces additional friction into transactions between merchants and customers that will likely result in increased payment rejections. To alleviate some of the burden, PSD2 allows certain payment types to be exempted, including the following:

- Low-value payments (under 30 EUR)

- Fixed-amount subscriptions (i.e., Spotify subscription) after the initial transaction

- Payments to whitelisted merchants (maintained by customer banks)

- Inter-corporation payments

MITs can also be exempted from SCA if payments are transmitted through payment gateways in a certain way. Credit cards will need to be authenticated on initial payments and customers will have to provide formal approval for future transactions.

Although this does enable automated and secure MIT billing, many merchants do not have the IT capabilities necessary to establish payment pathways for their unique business models. Many scenarios will require special attention, which highlights the need for merchants to have flexible and dynamic billing solutions that can fulfill any need.

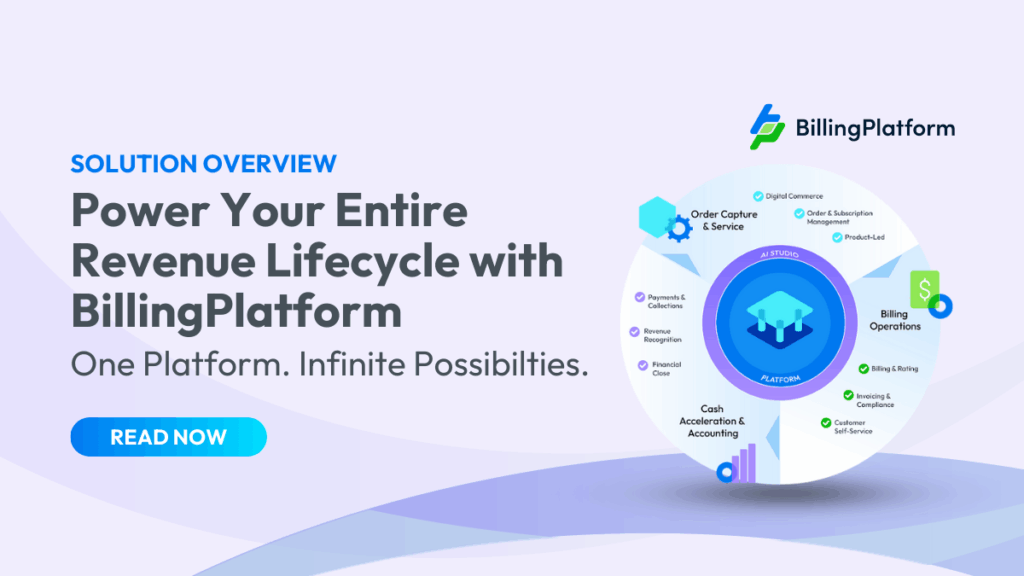

Managing PSD2 With BillingPlatform

BillingPlatform is a highly configurable, cloud-based solution that can support any user payment journey, no matter how unusual or complex. Our comprehensive platform can integrate with all enterprise ecosystems right out of the box and adapt to meet specific client needs.

For those who will be impacted by PSD2, BillingPlatform enables merchants to establish secure payment gateways for any MITs. Our solution can extend to bank financial systems to help recover rejected payments and handle any ambiguous billing scenarios that would otherwise create friction during the PSD2 transition. Clients can also integrate their customer-facing portals and use our system as a back-end solution to generate invoices and charge users.

We support customers all across the EU and are helping finance teams prepare for PSD2’s launch. With our expert help, EU merchants are empowered to implement SCA and manage exemptions for CITs and MITs. We are fully committed to growing with our clients through PSD2 and helping them differentiate their offerings for customers.

Interested in learning more?

Selecting a billing solution that supports your business needs is a challenge. Please download our Comprehensive Guide to Automated Billing Processes for more details.

Content is provided for informational purposes only and should not be relied upon as legal advice or to determine how the PSD2 may apply to you and your organization. We encourage you to work with a legally qualified professional to discuss PSD2, how it applies to your organization, and how best to ensure compliance. BillingPlatform makes no warranty, express or implied, or assumes any legal liability or responsibility for the information contained herein, including the accuracy, completeness, or usefulness of any information.