Are you still using spreadsheets in your accounting and billing workflows? In spite of all the negative press, there are plenty of good reasons to do so. I’d argue it’s the software vendors who are failing to deliver superior alternatives that should be vilified.

When you read vendors’ literature and a lot of the articles from the pundits, the use of spreadsheets is frequently vilified, described as a blight on the company or a testament to anachronism. Based on the portrayals you see, spreadsheet users may as well be riding a horse-drawn buggy while the competition is getting around in Teslas. To me, the prospective use of spreadsheets has been oversimplified, effectively positioned as a choice between these two scenarios:

- Excel = bad. Leaving the organization beset with manual, error-prone drudgery.

- Enterprise software = good. Delivering capabilities in an automated, powerful manner.

I’d suggest maybe it’s time to turn that narrative around. Maybe it’s the vendors who should be vilified. If Vendor X’s solution was really all that great, why are so many users still relying on Excel every day? The reality is that people have good reasons to use Excel:

- It’s a standard. You can share files with pretty much anybody, and you can export into Excel from pretty much anything, and vice versa.

- It’s inexpensive. Subscription pricing is nominal, even cheaper for corporations getting volume licensing.

- It doesn’t require outside assistance. Users can change formulas, generate reports and anything else they want without opening up a ticket, waiting for an admin or anything else.

- It’s familiar. Most finance pros have used it for their entire careers, and when they change companies, it’s essentially a given that those skills will continue to be applicable.

- It’s flexible. Excel can be a go to for pretty much anything, whether users need to do project management, build new financial models, construct new data sets, run ad hoc reports or pretty much anything else.

I could go on, but you get the picture.

When I collaborate with financial teams in enterprises, I continue to be impressed by how skillfully Excel continues to be employed. These teams have established strong capabilities and processes and continued to refine them over time. The expertise that’s amassed and the investment in formulas, logic and workflows can be significant and shouldn’t be trivialized or rejected out of hand. Spreadsheets have been a cornerstone for accounting and finance professions since the dawn of the PC, and aren’t going anywhere soon, nor should they.

In this context, I recently came across an article in Compliance Week that turns the whole “Excel bad/Enterprise software good” argument on its head: The story revealed how, in the scramble to adapt to ASC 606 and IFRS 15, many teams are having to resort to workarounds, manual efforts and, yes, spreadsheets because they can’t rework their legacy systems in time to meet upcoming reporting deadlines. Quite simply, after creating engineered, expensive and automated accounting and billing systems, teams are unable to adapt when substantive changes arise.

If you look at the list of advantages above, enterprise software vendors should look at whether their offerings can match up. As the saying goes, if you’re not part of the solution, you’re part of the problem.

What Are Your Barriers to Enhanced Efficiency and Agility?

However, whether you’re using spreadsheets or anything else, I do think it’s good to take a step back and take an objective look at what you’re doing today. While the “if it ain’t broke, don’t fix it” trope may hold its merit, it is important to truly take stock of whether something is broken or suboptimal. Try not to let inertia and familiarity with the status quo be an insurmountable obstacle to some significant improvements.

It is true that spreadsheet-based approaches do present their own set of risks. Data sets can be siloed. Hard-coded formulas can break. Circular references can pop up. And, when humans are making changes, no matter how skilled or experienced, errors can arise.

Further, at some point, you may hit a wall relying on spreadsheets. What happens if new dynamic pricing models need to be introduced? Say, for example, your organization has complex customer hierarchies, like reseller billing with advanced charge-routing and splitting capabilities. You need to apply single usage event rates multiple times across several related accounts with different rate structures. Do you try to do that using Excel?

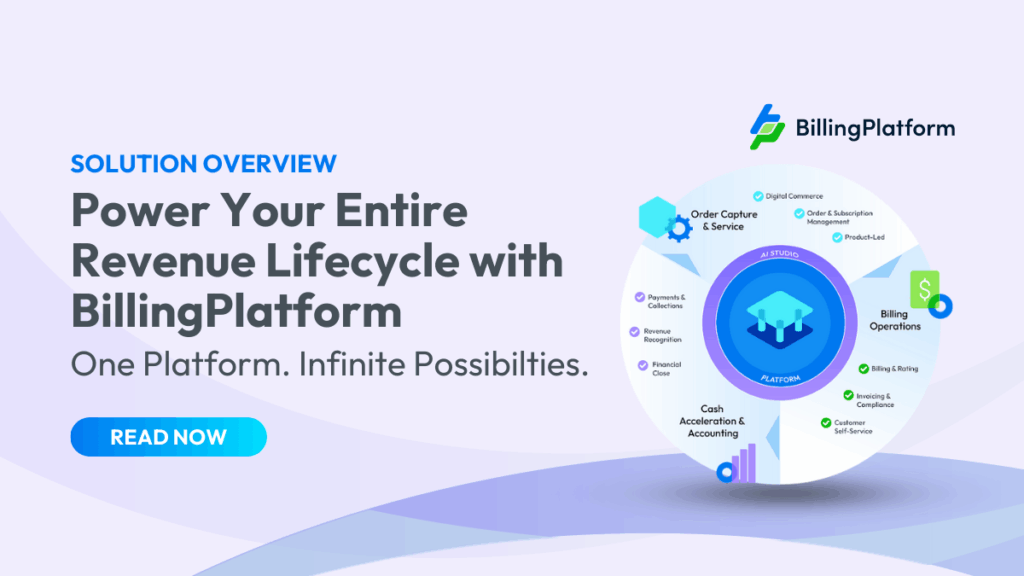

This is where I think we can offer advantages. With Billing Platform, you can define specific product and account data elements that can be used in formula-based rates or matrix style pricing. With the platform, you can efficiently handle these kinds of complex scenarios. In fact, you can use a point-and-click interface for configuring virtually any charging scenario—without entering into a full-blown IT development cycle.

Concluding Thoughts…and a Challenge

In the end, arguing that spreadsheets are an inherent evil that should be avoided at all costs doesn’t hold water. Even more so if the “solution” to the spreadsheet ills is a costly, rigid billing platform that is ill-equipped to deliver the agility that today’s digital age demands.

If you’re using spreadsheets in your billing processes, I’d respectfully offer you a challenge: if any part of your billing process is managed in a spreadsheet today, we can show you how to configure that same level of support in BillingPlatform—and allow you avoid the risks of the manual efforts outlined above. Don’t take our word for it. Let us prove it to you. Click here to get started.