Regardless of your industry or business model, revenue leakage happens. However, given its slow drip, it often goes unnoticed until it begins to impact your bottom line. While leakage will vary depending on your vertical, research has revealed some alarming statistics. MGI Research estimates that nearly half (42%) of companies experience some form of revenue leakage, and EY determined that companies should expect to lose 1% – 5% of realized EBITA on an annual basis. Further, a 2020 international survey, conducted by Boston Consulting Group, reported that 45% of executives see revenue leakage as a systematic problem for their companies. You need to ensure that all revenue is accurately accounted for, while simultaneously forecasting trends in customer behavior. This is where an enterprise-grade revenue management system can help.

While the figures above are disturbing, especially if you have or are currently combatting revenue leakage, there are common revenue leakage pressure points and ways you can plug the leak. But first, what is revenue leakage? Simply put, revenue leakage refers to money that’s been earned but not collected, and typically involves preventable revenue loss. While some industries are more prone to revenue leakage than others, it’s most common among companies where transactions involve contracts or ongoing customer relationships – such as subscription-based businesses. Cash transaction businesses, on the other hand, are less vulnerable to revenue leakage.

Why Revenue Leakage Happens and Where to Look for Leaks

Two of the biggest drivers of revenue leakage are disconnected systems and fractured feedback loops, but there’s more. Here are some of the most common causes of revenue leakage.

Manual processes

High on the list, the inefficiencies and errors resulting from manual processes, including spreadsheets and invoicing can contain mistakes and omissions. If you’re still handling billing manually, you’re at risk of not sending invoices in a timely manner, not sending some invoices at all, or sending invoices that contain errors.

Humans make mistakes and it’s not uncommon for them to lose track of billing cycles. When this happens and invoices are inadvertently not sent, do your customers tell you that they haven’t received the invoice? Chances are they don’t. Depending on the number of invoices not sent and amount due on each invoice, revenue leakage could equate to hundreds of thousands of dollars every year. In another example, let’s say you sell a product for $200, and the cost is mistakenly entered on the invoice as $20. If a purchase was made for 50 products, this single error will cost you $9,000 in revenue leakage.

Pricing errors

This type of revenue leakage occurs when promotions, discounts, etc. are not discontinued after the introductory or specified period of time. At first glance this may appear as an insignificant amount of revenue leakage however, a quick calculation tells a different story. Let’s assume that you provided a 30-day promotion that reduced the price of your software from $150 a month to $100. Let’s also assume that 250 customers took advantage of the promotion, and the mistake wasn’t caught for 2 months. Your revenue leakage for the two months would be $25,000 (250 customer x $50 promotion x 2 months = $25,000).

Data synchronization errors

Whether tracking customer information manually or using disparate systems, when data isn’t synchronized errors occur that lead to revenue leakage. To illustrate, let’s say you sell a 30-seat CRM software package to a company for $125.00 per seat/per month. Each month you should receive $3,750 or $45,000 annually. However, due to disconnected systems, you’re only charging for 20 seats each month, which results in an annual revenue loss of $15,000.

Expired credit/debit cards

When credit or debit cards expire or are canceled, it sets off an arduous and labor-intensive chain reaction. It’s been estimated that every month, 12% of all credit cards will fail and only 15% of the charges will be recovered. Even if the products and services you sell aren’t high ticket items, the sheer number of customers with canceled or expired cards could put a dent in your revenue.

Unintentional churn

As discussed above, expired credit and debit cards are a contributing factor to revenue leakage. When left unchecked, customers, who may otherwise have had exceptional experiences, may feel they have no other choice than to go to a competitor.

Lax policy adherence

Do you charge early termination fees or other penalties? If so, this is another area that encounters revenue leakage when penalties aren’t enforced.

International requirements

If you operate on a global basis, you know only too well that each country or region has its own billing requirements, payment methods, currency, taxes, etc. When costs aren’t correctly converted you may end up sending invoices for less than what is owed.

In addition to the above, subscription-based software as a service (SaaS) companies encounter additional areas where revenue leakage occurs. For instance, many SaaS businesses offer free trials to entice prospects to become paying customers. Revenue leakage occurs when prospects repeatedly take advantage of free trial offers instead of purchasing the product. Additionally, with upgrades and downgrades a key component of SaaS businesses, customers are free to do either at will. What happens when a customer that is receiving a discounted rate downgrades their software tier? If the discounted rate remains in force, the customer continues to benefit from the discount, and you’ll encounter a loss in revenue.

Although the revenue leakage landscape may look bleak, there is a way to lessen the flow – a revenue management system.

What is Revenue Management?

So what exactly is revenue management? Considered to be both an art and a science, revenue management involves the use of analytics and performance data to help organizations predict their customers’ behavior at the micro-market level. All to optimize product availability by leveraging price elasticity to maximize revenue growth and profitability. In other words, it’s about selling the right product to the right customer at the right time, the right price, and through the right sales channel. Put even simpler, it’s about how you sell your products or services to meet the changing needs of buyers.

The benefits of a revenue management system are numerous, starting with increased revenue and profits. Harnessing a revenue management system is appropriate for any business that has high fixed costs and low variable costs. Essentially, the higher the fixed costs, the more revenue a company needs to generate to break even.

Consider your favorite airline. Whether the flight is filled to capacity or just has a dozen passengers, airlines encounter significant fixed fees. Aside from aircraft and depreciation costs, other fixed costs include insurance, fees to booking agents and booking sites, staff and management, fuel, take-off and landing fees, airplane parking fees, ground handling fees, airport and government taxes, fees to governments for each country the plane flies over, as well as other fees that are more difficult to quantify.

While these fees are closely linked to airline ticket prices, for airlines to profit they need to fill the plane to capacity, charge more per seat during high travel seasons and to preferred destinations, etc. To accurately charge different prices for preferred seating, flight time of day, destinations, seasons, etc.; airlines need to have an exceptional understanding of customer preferences and be able to forecast short- and long-term consumer needs.

A Revenue Management System Stops Revenue Leakage in its Tracks

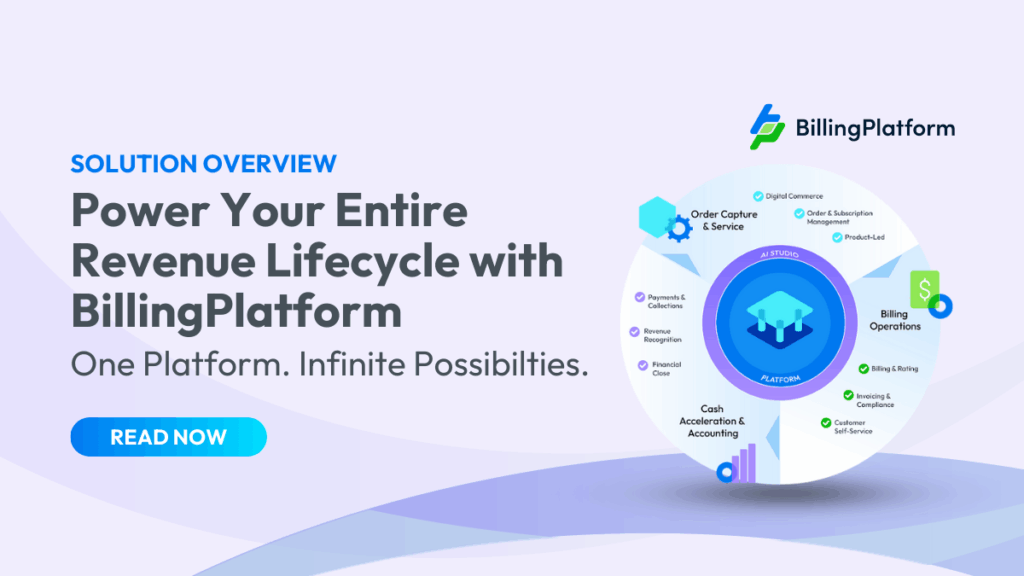

Revenue leakage doesn’t have to be a byproduct of doing business. BillingPlatform provides the automation, accuracy, and auditability needed to simplify revenue management. Our single solution enables you to automate revenue management, reduce errors, and manage end-to-end quote-to-cash and revenue recognition processes. With our enterprise-grade, intelligent revenue recognition software, you’re able to streamline revenue management, allocate, reconcile, monitor, and recognize revenue for any pricing model, billing approach, or promotional offer, and stay compliant with ASC 606 and IFRS 15 – while plugging revenue leaks.

In the words of Frank Davis, senior vice president, digital transformation at Emburse, “With BillingPlatform, we will be able to automate complex billing and pricing structures, support our ASC 606 revenue recognition requirements and optimize our invoicing and rebate management processes, which will be a key driver of our future growth initiatives.”

Are you ready to join Emburse, and other companies like them with a complete revenue management system? By partnering with BillingPlatform you’re able to reduce revenue leakage and turn your growth strategies into a reality. Learn more by speaking with our experts today.