When you hear the phrase revenue recognition, what’s the first thing that comes to mind? If you’re like most people, your first thought is of a process that is complex, time-consuming, and error-prone. And you would be right. Even in the most basic scenarios, taking revenue to the recognition stage can be problematic. What if you could simplify your revenue recognition processes while reducing errors? This blog focuses on the 5 steps of revenue recognition with ASC 606 in mind, as well as how you can automate and simplify the process.

Revenue Recognition: What it is and Why it’s Important

Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized and determines how to account for it. Essentially, the revenue recognition accounting principle states that revenue needs to be recognized as it is earned. The question then becomes: when is revenue considered “earned”? Generally, revenue is recognized after performance obligations are fulfilled, like when a product or service is delivered. Basically, this means that you can only recognize revenue once your obligations have been met – not necessarily when payment is received.

The next question that typically comes to mind is: why is the revenue recognition principle important? As revenue recognition is a direct reflection of your business integrity, accuracy is essential. When we loop back to the revenue recognition principle, it provides the ability for your company to record revenue as it is earned and enables you to produce more accurate profit and loss statements. However, it’s important to remember that revenue recognition standards can vary based on the company’s accounting method, geographical location, whether the business is a public or private entity, as well as other factors.

The revenue recognition principle provides the construct, but determining what constitutes a transaction can take more time and consideration. Issued by the Financial Accounting Standards Board (FASB), ASC (Accounting Standards Codification) 606 was designed to decrease complexity and create an industry-neutral revenue recognition model. We’ll examine ASC 606’s 5 steps of revenue recognition in the next section.

The 5 Steps of Revenue Recognition Compliance

In keeping with ASC 606 principles and to achieve compliance, the following five steps must be satisfied.

Step 1: Identify the contract with the customer

Depending on your company’s procedures, the contract can be written, verbal, or even implied. However, there are essential components to identify, such as the goods or services that will be transferred and payment terms. Additionally, ASC 606 introduced the requirement to combine multiple contracts into one for financial reporting purposes.

Step 2: Identify the performance obligations

The performance obligations form the benchmarks for when and how revenue is recognized. This consists of the goods, services, or bundles that will be transferred to the customer.

Step 3: Determine the transaction price

This is the amount the customer pays to the business upon contract completion. The contract may include fixed considerations, variable considerations, or both, and the price refers to both cash and non-cash considerations, as well as discounts, rebates, coupons, etc.

Step 4: Allocate the transaction price to the performance obligations

Essentially, there are three methods when allocating the transaction price among performance obligations – adjusted market approach, expected cost plus margin approach, and residual approach. Given the continuous performance obligations found in software as a service (SaaS) companies, these organizations can split the total amount of revenue to be recognized among each performance obligation.

Step 5: Recognize revenue when (or as) a performance obligation is satisfied

Revenue is recognized as performance obligations are satisfied, whether over time or at a specific point in time.

While the above provides a high-level view of the five steps, details within each of the steps are much more complex. As you can see, manually handling ASC 606 principles can become complicated, time-consuming, and error-prone.

Simplify Revenue Recognition with Automation

Manually handling billing functions is difficult, add to that ASC 606’s compliance requirements and spreadsheets aren’t enough. If you’re looking to simplify the process and ensure you’re always in compliance – automation is the answer.

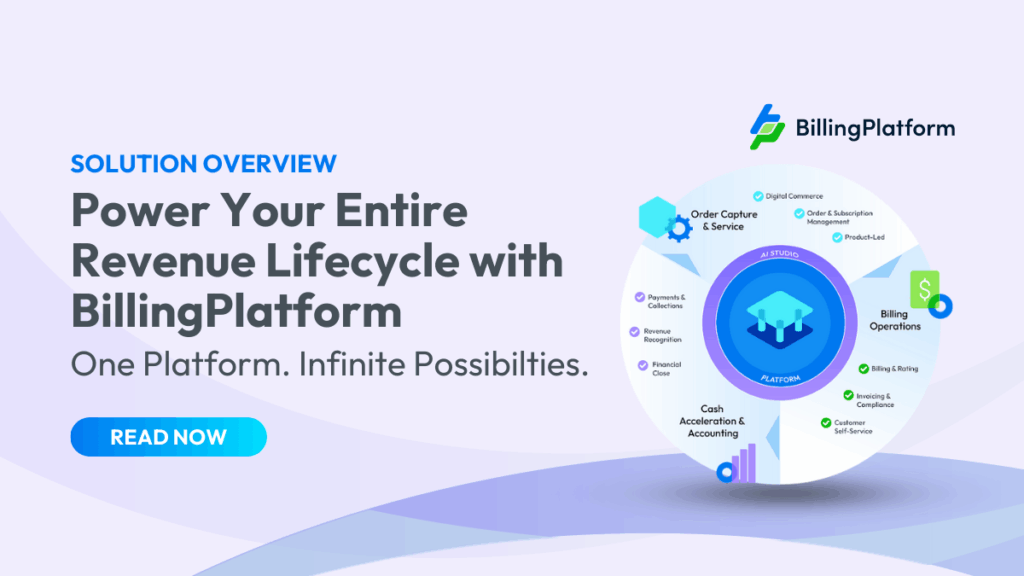

BillingPlatform automates revenue management and reduces errors. Our software combines billing and revenue recognition in a single solution to manage the complete quote-to-cash. All while automating the 5 steps of revenue recognition. The intelligent revenue recognition software allows you to easily streamline revenue management to allocate, reconcile, monitor, and recognize revenue for any pricing model, billing approach, or promotion – while staying compliant with ASC 606 and IFRS 15.

With us you’re able to:

- Manage transaction complexity and deliver true real-time revenue management.

- Manage revenue contracts, and automatically calculate revenue allocated to performance obligations based on a standalone selling price.

- Provide finance teams the flexibility to automatically allocate transactions to specific GL accounts and specify how and when revenue is recognized.

- Align the 5 steps of revenue recognition with your enterprise’s broader business strategy by creating custom revenue schedules and automate recognition of even the most complex transactions.

- Manage revenue recognition across multiple subsidiaries and geographies.

With BillingPlatform as your revenue recognition partner, you’re able to reduce risk and easily adhere to strict compliance standards. Learn more from our experts and request a demo today.