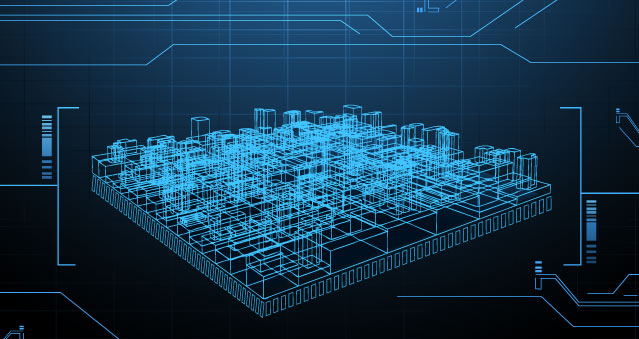

On the surface billing is an easy concept to understand, however there are numerous independent applications that work in unison to create the billing system architecture. Each of these components provide the functionality required to create a billing system architecture that enables you to move beyond basic billing functionality to handle the complexities of today’s billing requirements.

Billing requirements may vary between industries and from company to company. However, there are certain billing components like the billing engine, rating engine, and payment processing that are core to every billing system.

Breaking Down Billing System Architecture

Let’s look at a typical billing system architecture from the view of the telecoms industry – an industry that has one of the most, if not the most complex billing requirements. Each of the systems within the billing architecture serves a distinct purpose as described below.

CRM/OMOF

The Customer Relationship Management (CRM)/Order Management and Order Fulfillment (OMOF) applications connect with the billing system and the billing system connects with the provisioning system. Alternatively, CRM/OMOF can connect directly with the provisioning system.

Provisioning System

Generally defined at the network server, application, and user levels, it’s the process of preparing, assigning, and activating IT infrastructure components, such as servers, storage, and networks to meet user requirements.

Network Inventory System

Network inventory is a list of devices such as computers, routers, servers, and printers which are connected to the network. It represents the automated processes that allocate resources, determine configuration changes, and invokes activation.

Billing Engine

This component generates invoices based on the charges calculated by the Revenue Engine. Additionally, it manages billing cycles, payment due dates, and payment reminders.

Rating Engine

Rating provides the ability to create pricing scenarios that best match the value of your products/services. Taking it a step further, it calculates price based on a combination of factors, which is then used by billing to create customer invoices.

Discount Process

In its most simplistic description, it is a charge type in the product catalog through which businesses offer price reductions on different types of charges like subscription, usage, one-time, etc. Discounts can be based on a fixed amount, a percentage, bundles, volume, promotions, groups, and more.

Credit Control

Essentially, it’s a practice to ensure payments are made based on the payment terms stated within the invoice. Credit Control can be classified in two types – unbilled usage based and billed usage based. Unbilled usage is defined by the customer’s usage and total charges compared to the predetermined credit limit. Billed usage occurs after the invoice has been generated and relates to the revenue collection process.

Report Generation

This encompasses extracting data from databases and organizing and exporting the data for reports and dashboards.

Payment Processing

Typically involving authorization, authentication, and payment settlement, it encompasses the handling of financial transactions between a customer and the organization.

Mediation System

This software engine provides the ability to collect raw usage data from multiple sources and normalize the data for consumption by downstream systems.

Data Warehouse

Used for reporting, business intelligence, and data analysis, it is the central repository of data collected from disparate systems.

Enterprise Resource Planning

This component provides the automation of processes found in many of the organization’s functions such as finance, human resources, manufacturing, supply chain, services, procurement, etc., enabling businesses to seamlessly manage departmental processes.

Payment Gateway

A third-party system that allows businesses to securely accept electronic payments such as credit/debit cards, digital wallets, and other payment methods.

Network Switches

Equipment that connects two more IT devices to create a communications network for the purposes of sharing IT resources across the network.

The Foundation for Flexibility

Now that we’ve covered the architecture of a billing system, let’s look at the 8 applications that provide billing system flexibility.

- Customer Management: Handles the inbound and outbound contacting of customers and manages the contact lifecycle.

- Order Management: Provides the functionality to capture the product/service order, manage the order entry lifecycle, and monitor the order completion lifecycle.

- Sales and Marketing: From managing campaigns and tracking prospects through providing sales support and handling commissions, to analyzing product performance; the billing system automates many of these functions and processes.

- Rating: Given the variety of products and services most organizations offer, rating provides the capability to create different rate plans and capture usage.

- Invoicing: The invoicing component generates bills, processes payments, performs account administration, maintains tax information, and processes financial data.

- Multi-Currency/Multilingual Support: Provides support for multiple currencies and multiple languages for use across different business units, as well as allows the user to define which currencies to use for billing, rating, and reporting.

- Compliance: Used to align to any standard, as well as provides the ability to tailor billing practices across all domestic and international business units in accordance with current accounting standards. Additionally, it maintains internal controls over financial reporting and the privacy of customer data with SOC 1 & 2 compliance.

- Security: Keeps confidential customer data protected and provides continuous monitoring for malicious activity and unauthorized behavior. Further it monitors traffic for abnormal activity, provides multi-factor authentication, and allows for a source code review process to help identify, prioritize, and resolve security issues.

It’s important to note that not all billing solutions provide every one of these systems and applications. However, it’s only with the above that you’ll gain the full range of flexibility from your billing system architecture.

Advantages of Billing System Architecture Flexibility

You can’t underestimate the value of an agile and automated billing solution. Here are the top 8 benefits you’ll receive with a billing system architecture built for flexibility.

- Reduce Costs and Errors. Automating business tasks eliminates tedious, time-consuming, and error-prone billing activities like creating invoices, receiving payments, sending payment reminders, recognizing revenue, etc.

- Generate New Revenue Streams. Experts estimate the number of Internet of Things (IoT) connected devices will exceed 29 billion in 2030. This nearly doubles the 15.1 billion devices recorded in 2020. Organizations will offer new and innovative products and services faster than ever. But billing for these offerings requires the ability to process and normalize data received from disparate systems and devices. A built-in mediation engine converts raw usage data received from multiple sources into revenue.

- Improve Speed to Market. Modifying pre-packaged solutions often requires skilled IT personnel, which is time-consuming and expensive. A flexible billing solution enables organizations to launch new products/services or develop new pricing models/promotions quickly. It can take just hours rather than months!

- Adapt to Market Demands. Customers want tailored payment models that are intuitive and easy to use. Architecting billing systems as true software platforms makes them highly customizable. So you can support any payment plan no matter how complex.

- Transform Billing into a Value-Added Function. PaaS billing solutions reduce operating costs, boost scalability, require less maintenance, and offer flexibility, transforming the very nature of billing. Now a costly back-office process moves to the front office, reducing capital expenses and enabling the monetization of what was previously an operational expense.

- Extend the Financial Ecosystem. Flexible billing system architecture integrates billing with critical front- and back-office systems like CRM, ERP, general ledger, tax systems, etc. This creates a seamless financial ecosystem for easy extraction and management of data that is always in sync.

- Improve Data Security. Traditional billing systems provide basic security measures, but are more prone to cyberattacks that can have devastating effects. And cybercrimes continue to increase in severity and frequency. A flexible solution provides enterprise-grade security that keeps pace with ever changing threats.

- Enhance the Customer Experience. Customers expect you to know them and their preferences. A flexible billing system provides the information needed to personalize customer interactions, quickly respond to changing requirements, and automate communications.

Outpace the Competition with a Flexible Billing Solution

When it comes to billing, you don’t need to make the virtually impossible choice between simplicity and flexibility. BillingPlatform delivers both the simplicity and the agility needed to transform the way you do business.

Unlike other billing solutions, BillingPlatform’s cloud-based platform was built to provide the business agility today’s organizations require. Leveraging a rules-based workflow engine, our solution maximizes efficiencies by automating business processes to monetize any revenue opportunity, deliver a frictionless customer experience, and gain competitive advantage. Contact us to learn more today.