Quote-to-cash (QTC), a term used to describe the sales cycle processes that drive revenue, is often an area that many companies find difficult to optimize. These processes touch nearly every function within your organization, including sales, account management, order fulfillment, finance, legal and customer service. If we take it a layer deeper, the end-to-end process covers the deal or opportunity, pricing, issuing the quote, fulfilling the order, invoicing the customer, receiving the payment and recognizing revenue. With so many touchpoints (the prospect, internal resources and systems) this cross-functional, multi-layered process is prone to delays, errors, miscommunication and unfulfilled customer expectations.

Is Quote-to-Cash a Weak Link in Your Organization?

Although one of the most vital processes to the livelihood of organizations, many times quote to cash consists of manual effort and legacy systems. This leaves you open to weaknesses within the processes. Weaknesses that at best can be resolved through resource utilization or even an outlay of cash, and at worst resulting in the loss of a customer and a hit to your profitability.

Does your company spend time discussing the quote to cash process or conduct periodic postmortems? If the answer is no, you’re not alone. In fact, you may even be thinking, why do I need a formal QTC process?

When the process remains status quo, how can you identify problem areas and fine-tune the process so that your opportunities move quickly and seamlessly from opportunity to revenue recognition? Let’s take a look at how you can identify some of the weak links in the process, and ways your QTC process can operate at maximum efficiency.

Identifying The Problem Areas

To begin, let’s look at some high-level questions that you should ask yourself and the teams involved in the process.

- Are you able to quickly and easily launch new offerings and pricing models?

- Do your teams struggle to create competitive quotes, and do they often result in quotation errors and purchasing delays?

- What types of errors do you encounter during order fulfillment?

- Are invoices always accurate and sent on a timely basis?

- Do you encounter payment delays, and is there a time-lapse before they are resolved?

- Is your revenue recognition process error-free and in compliance with ASC 606 and other regulations?

- Have customers complained or even churned because of your QTC process?

With answers to these questions, you now have a baseline for determining where glitches appear in the process. For example, say you run a manufacturing company and your days sales are outstanding averages 45 days instead of the normal 30 days or less. Upon further research, you realize that many of the processes are being handled manually, ultimately resulting in errors and delays. To streamline the process and avoid bottlenecks, you should consider a fully automated billing system that quickly and effortlessly manages all of your critical billing activities.

Get the Most From Your Quote-to-Cash Processes

Now that you have a better idea of where breakdowns are occurring and their possible causes, let’s take a high-level view of some of the benefits you can receive when your QTC is optimized.

First and foremost is automation. Automation and seamless integration to your customer relationship management (CRM) and enterprise resource planning (ERP) systems provides the foundation for a healthy quote to cash process. One of the first steps in the process is to configure the products and services, determine the pricing and apply promotions, discounts and coupons. With an automated system, you can quickly configure the best possible solution, and determine a competitive pricing strategy without cutting into profit margins. When this information is accurate, you’re able to create an error-free quote in less time. Think about the benefits of generating a quote in just minutes instead of hours! This is a key step in the process because the quote not only needs to be error-free, but personalized and delivered to the customer quickly. By improving this part of the quote to cash journey, you’re able to make a positive impression on the prospect and win deals faster.

Once the contract is signed, order processing and fulfillment needs to happen quickly and accurately. When you struggle with orders that were entered inaccurately, are incomplete or find yourself handling lost or misplaced orders, you’ll encounter delays in order fulfillment that will have a negative impact on the customer experience. To ensure that the right products and services are delivered on time, this back-end process needs to be fully optimized. This means that you need 360-degree visibility of orders and order fulfillment, which will enhance the customer experience and help facilitate repeat purchases – giving your bottom line a boost.

Winning the deal and delivering the order on time won’t do you much good if you have gaps in your invoicing, payment and receivable processes. This step is often plagued by fragmented processes, manual intervention and limited visibility. All of which can lead to revenue leakage. To capitalize on your hard-earned revenue as soon as possible, you need to ensure invoices are accurate and sent on time, and payments are tracked and followed-up on quickly. Doing this requires a system that automates invoicing, approvals, dunning, notifications, account receivables, and more.

Streamline Your QTC Processes

An automated quote to cash system gives you the control needed to handle QTC processes with precision. Since most errors are a result of human mistakes, automating the process helps reduce the chances that you’ll encounter an error that could negatively affect your customer and your revenue stream.

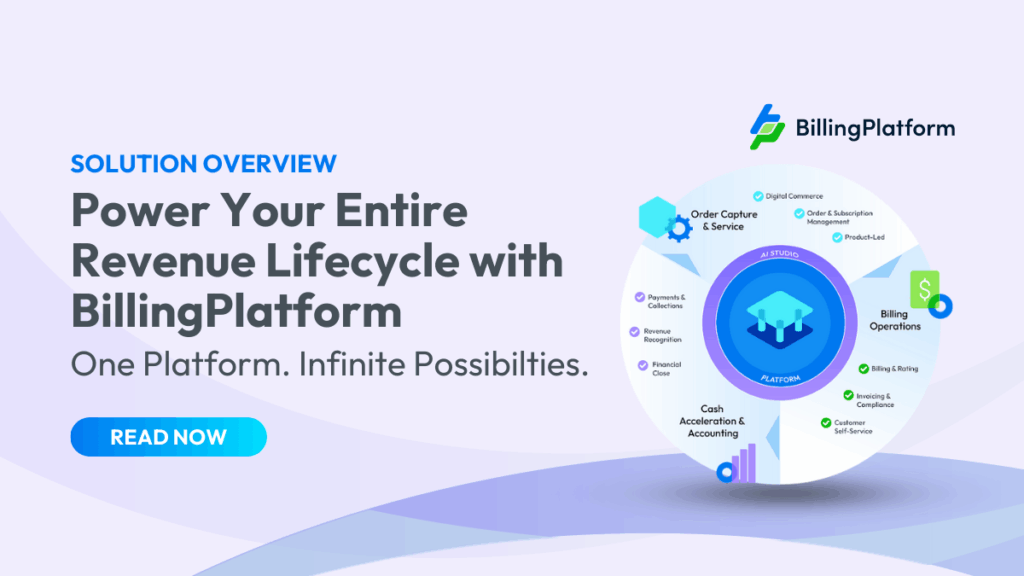

To reap the benefits and fulfill 100% of your business requirements, you need a complete solution. One that spans mediation, rating, invoicing, collections, reporting, analytics, revenue recognition, and A/R sub ledger. At BillingPlatform, we deliver the core capabilities that automate the quote-to-cash processes in every pricing tactic, enabling you to focus on growing your business.