Teams commonly spend up to 10 days—one third of each month—simply closing the books from the prior month. On the other hand, there are companies that spend closer to five days on closing efforts. What makes the difference? Look to data, processes and integrations.

Yesterday’s dirty dishes. For me, there’s no joy in coming into the kitchen in the morning to find yesterday’s dishes stacked high. The dread of digging out from yesterday before you can start today is bound to be a familiar feeling to many folks in the finance department.

I recently came across an article on CFO.com that examined some survey findings from the APQC around monthly close cycles. The survey shows that in 25 percent of organizations, monthly close takes 10 days—that’s one-third of each month consumed by wrapping up the prior month.

The author points to two key culprits that are most likely to be responsible for these dragged out close cycles: data and process. When it comes to data, consider this: Businesses that employ a standard chart of accounts across the organization typically have a close cycle that’s two days shorter than organizations who don’t standardize in this way. When it comes to improving processes, the author cited a few key strategies: maximizing preparation in advance of close, documenting and optimizing workflows, and communicating regularly, for example, alerting stakeholders to deadlines several days in advance.

In reviewing these findings, it struck me that having stove-piped systems is an underlying challenge that can counter any efforts aimed at enhancing either data or processes. Put another way, by maximizing integration of the various systems that ultimately contribute to ongoing efforts like monthly close, organizations can be much better equipped to improve data quality and processes. By doing so, you can accelerate monthly close and much more.

If billing data needs to be manually exported, aggregated and standardized before it gets entered into the corporate accounting system, it creates a number of potential implications:

- Data quality can suffer because manual efforts may introduce errors.

- Relying on staff members to handle these efforts can introduce delays and unpredictability that can throw off downstream schedules and processes.

- Finally, the time spent handling this routine effort every month represents time that can’t be dedicated to more strategic, forward-looking efforts, like planning, analysis and optimization.

Like trying to pretend yesterday’s dishes aren’t there, these lengthy, labor-intensive tasks don’t go away just because they’re being ignored. In fact, about the only certainty is that the problems and costs only escalate. For example, what happens if new business models are launched or a company is acquired? How does the organization suddenly contend with an entirely new set of pricing models, workflows, systems and so on?

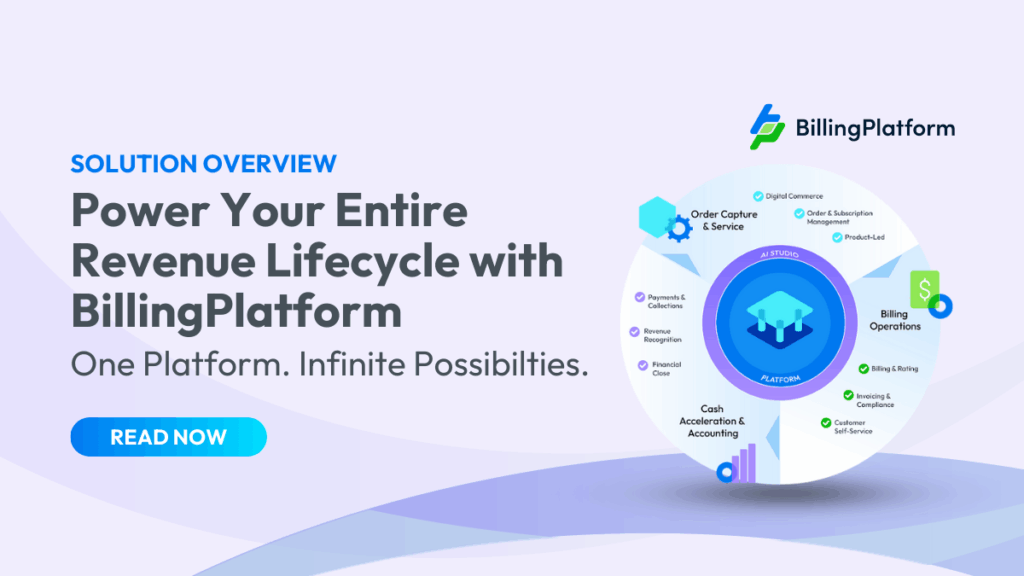

So absolutely, look at opportunities for enhancing data and processes, but be sure to look at integration opportunities as well. When you can optimize integration between billing, ERP and accounting systems, as well as front-end systems like e-commerce and online catalogs, ongoing efforts like monthly close can be accelerated, while reducing the associated costs and efforts. (Learn about Billing Platform’s integration capabilities here.)

Even better news is that when this integration takes place, not only can monthly close be accelerated, but a central aggregation of data will result, which presents a massive opportunity for enhanced business intelligence. (See how Billing Platform can help customers maximize the insights found in business data.) By undertaking this kind of integration, one of our customers was able to gain insights that fueled improvements in a number of areas, including sales, accounts receivables, product utilization and taxation.

When you look at your metrics like monthly close cycle times, where does your organization fit? Closer to five days or closer to 10? Where are your bottlenecks and where have you made strides?